What is the Transient Occupancy Tax (TOT)?

The TOT or Bed Tax is a 15% tax collected by the City of Carpinteria over the rental rates charged for occupancy of room or rooms, or other living space, in a hotel, inn, tourist home or house, motel or other lodging establishment for a period of 30 consecutive days or less. The Transient Occupancy Tax is authorized under the State Revenue and Taxation Code Section 7280, as a source of non-property tax revenue to local government.

What is the definition of Transient related to the TOT?

“Transient” means any person(s) who occupies a room, house, motel, condominium or other lodging establishment for 30 consecutive days or less in exchange for money, in-kind services or trade, etc. with the property owner or operator for the right to occupy the space.

How is the TOT collected?

The establishment operator or manager is responsible for collecting the tax from the “transient” who pays the charge above the rental rate. The owner/manager must:

- Submit an application for a City of Carpinteria Standard Business License or Short-term Rental License (for “Vacation Rentals” and “Home Stays” only).

- Complete a TOT Remittance Form

- Post and retain a Registration Certificate and Business License in each rental unit. The License and

Certificate will be issued by the City.

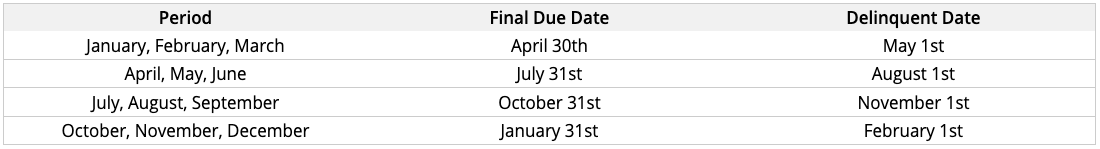

Remittance of TOT is required on a quarterly basis to the City Finance Department. The owner/operator may choose to remit fees to the City at a shorter interval, but not greater than a quarter. See dates below.

Can I rent my unit as a Short-Term “Transient” rental?

If your unit is located in a zone permitting part-time, short-term or transient rentals within the City of Carpinteria you may be permitted to do so.

The following zones permit transient occupancy rentals:

PRD – Planned Residential Development District

PUD – Planned Unit Development District

CPD – Commercial Planned Development District

You may not rent in R-1 – Single Family Residential

What is a Short-term Rental License and do I need one?

If you rent to a transient for 30 consecutive days or less, and/or you advertise that your unit is available for less than 30 consecutive days, and receive income, services, trade, etc for the occupied space you must obtain a Registration Certificate. Upon application approval, the City will issue you a unique numbered Certificate for each unit that you rent. This Certificate must be prominently displayed in each unit.

Short-term Rental Licenses must be renewed annually, regardless of whether units were rented or not.

Who needs a Business License?

The owner and the operator/manager will be required to obtain either a City of Carpinteria Standard Business License or a Short-term Rental License, depending on the zone district and type of business. If you operate or live out of the City limits, you will still be required to obtain an “in City” Business License as you are conducting business within the City.

What is the Cost for a Standard Business License?

The current application fee for Standard Business License is $155.00 for a business in the City limits and $20.00 for a business outside the City limits, the base tax fee varies by business type and number of employees, plus $11.00 per rental unit. In addition there is a State-mandated Disability Access Fee of $4.00 per Business License. Renewal of an existing Business License will not require an application fee but will require payment of the base tax, the $11.00 per unit and the State Disability Access Fee of $4.00. There is no separate fee for the Registration Certificate issued with the Business License.

What is the Cost for a Short-term Rental License?

The initial application fee for a Short-term Rental License is $390.00, which includes the base tax fee and a State-mandated Disability Access Fee of $4.00. The annual renewal of an existing Short-term Rental License will be $80.00. There is no separate fee for the Registration Certificate issued with the Short-term Rental License.

Are there any exemptions to collection of the TOT?

Any federal or California state officer or employee can be exempted from this tax if stay is due to official business; and/or any foreign government officer or employee who is exempt due to an express provision of federal law or international treaty. The exemption will not be granted unless a claim is requested at the time of rent collection.

How are TOT funds used?

TOT funds help pay for general government services such as law enforcement, Parks, sidewalk maintenance, recreation programs, etc.

Who can contact if I have more questions?

If you have further questions, please call (805) 389-3554 or email carpinteriatot@hdlgov.com

© 2026 City of Carpinteria. All Rights Reserved.

© 2026 City of Carpinteria. All Rights Reserved.